- Locate the

account in question and access the Transactions area.

- To

access Accounts from the Home screen, do one of the following:

- Click Accounts on the navigation panel.

- Click Areas > Accounts on the menubar.

- Click the down arrow next to Home on the options bar and select Accounts.

- Click Locate on the options bar.

To access Accounts from another area of the program, do one of the following:

- Click Home > Accounts on the menubar.

- Click the down arrow next to Home on the options bar and select Accounts.

- Click Locate on the options bar.

- In the Locate account dropdown menu, select Broker, Client, Finance Company, or Other Interest.

- In the Locate by dropdown menu, select the appropriate option.

- Select the suitable checkbox

or checkboxes

to the right.

- Insureds (available only if Clients is selected in the Locate Account field)

- Prospects (available only if Clients is selected in the Locate Account field)

- Additional Interest (available only if Other Interest is selected in the Locate Account field)

- Bill to (available only if Other Interest is selected in the Locate Account field)

- Certificate Holder (available only if Other Interest is selected in the Locate Account field)

- Active

- Inactive

- Enter the

first few letters of the name, policy number, phone number,

etc. (depending on the selection in the Locate

by dropdown menu) and press [Enter]

or click Locate.

Note: Location by phone number searches all phone numbers associated with client and contact accounts (e.g., residential, mobile, fax). - The Results list displays all of the accounts that match the criteria you entered. Click on a column heading to sort the list by that category. For example, click the Last Name column heading to sort by last name in ascending order. To sort in descending order, click the Last Name column heading again.

- Highlight the desired item in the Results list.

- Click Transactions on the navigation panel or Areas > Transactions on the menubar.

- To

access Accounts from the Home screen, do one of the following:

- The Transactions list

initially loads blank. Enter

your desired search criteria to populate the list for the selected

account.

Note: The list can display a maximum of 500 transactions.To change the way transactions display when you populate the list, click the word Transactions in the view filter.

A list of choices displays.

- Balance Forward: Displays one row per item

- Open Item: Displays the original rows as well as any credits/debits or other charges applied to those items

- By Bill #: Displays the transactions for each invoice rolled up into a single detail line.

Click on the appropriate selection.

Use the search bar to display transactions that meet specific criteria. Apply a single filter (using the search fields) or multiple filters (using the Edit Filter button

) to narrow the list

of transactions.

) to narrow the list

of transactions. Selecting multiple criteria performs an "and" search (for example, transactions in a specific Accounting Month with a specific Bill Mode).

- Click the Edit

Filter button

.

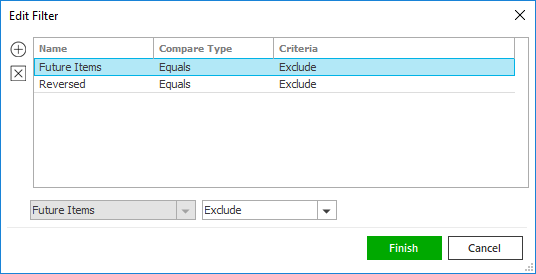

. - The Edit Filter

pop-up window displays. Click the Add

button

to add filters.

to add filters. - Select and/or enter search criteria

using the dropdown menus and fields. Click the Add

button again to apply additional filters. Enter additional

search criteria.

Click the Delete button to remove a filter from the list. - Click Finish

when you have applied all of your desired filters.

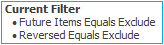

Hover over the Search where text to see the filter that is currently applied to the list.

To clear the currently applied filter (for the current session only) and start over, click the Clear Filter link label. The search bar displays in blue when filters are applied and in gray when filters are cleared.

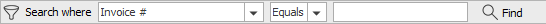

- Make a selection in the first dropdown menu.

- The choices available in the second dropdown menu vary, depending on your selection in the first dropdown menu:

- Equals/Greater Than/Less Than/Does Not Equal: Enter the search criterion (e.g., the full description) in the field to the right, or select a date from the dropdown calendar (if applicable).

- Contains: Enter at least one character of the search criterion (e.g., part of the description, invoice number, etc.) in the field to the right.

- Within Range: Search between two calendar dates. Click the down arrow to the right of each field to choose dates from the dropdown calendars.

- Exclude/Only/Include: Select to exclude or include items that meet the criterion selected in the first dropdown, or to display only items that meet that criterion.

- Click Find

to apply the filter. Hover over the Search

where text to see the filter that is currently

applied to the list.

Your filters are saved automatically for the selected account, except when you open the Transactions list from the Access menu.

To clear the currently applied filter (for the current session only) and start over, click the Clear Filter link label. The search bar displays in blue when filters are applied and in gray when filters are cleared.

To save your currently applied filters as a default for all accounts of the same entity type, create Filter Defaults. Your currently applied filters are saved as a default for the selected account automatically. Filter defaults are unavailable on Transactions lists opened from the Access menu, as Access > Transactions already provides a filtered view.

Your filter defaults are unique to your user code and will not affect other users’ saved defaults.- Click the Filter

Defaults link label and select the Use as default checkbox

on the Filter Defaults

screen. The filter default will only be applied to

accounts that do not already have filter defaults

applied.

Filters listed in italics (e.g., Bill #, Billed to Acct, Invoice #) include search criteria that will not apply to all accounts. These filters can only be saved as defaults for the selected account.

To replace existing filter defaults for all accounts (including accounts of the same entity type that already have other filter defaults saved), select the Override existing filters for [entity type] checkbox. Click OK to apply the filter default.

To clear a filter default, click the Clear Filter link label, click the Filter Defaults link label, select the appropriate checkboxes in the Filter Defaults window, and click OK.

- You can change

the columns that display in the list if you wish.

- Click the Select Columns link label on the right side of the header bar. The Select Columns window displays.

- Select the checkbox

next to each column that should be included in the list.

Deselect the checkbox next to each column that should be removed from the list. - Columns will display in the order in which they are listed.

To move a column up or down in the list, click the column and then click the up arrow

or down arrow

or down arrow  to change its position.

to change its position. - Click OK or press [Enter] to save your changes.

Click Cancel to close the window without saving your changes.