- Access the

Receipts area.

- To access the General Ledger area from the Home screen, do one of the following:

- Click General Ledger on the navigation panel.

- Click Areas > General Ledger on the menubar.

- Click the down arrow next to Home on the options bar and select General Ledger.

To access the General Ledger from another area of the program, do one of the following:

- Click Home > General Ledger on the menubar.

- Click the down arrow next to Home on the options bar and select General Ledger.

- Click Receipts on the navigation panel or Areas > Receipts on the menubar.

- The Receipts screen displays.

Enter your desired

search criteria to populate the list.

To locate receipts that match specific criteria, use the search bar. Make a selection in each dropdown menu to locate the desired receipt. The fields vary, depending on the menu options you choose.

These are the choices in the first dropdown menu:

- Account Code

- Accounting Month

- Amount

- Bank Account

- Bank Status

- Date Entered

- Description

- Effective Date

- Entered By

- Export Batch #

- Exported By

- Exported Date

- GL Schedule

- Payment ID

- Posted By

- Posted Date

- Refer #

The choices available in the second dropdown menu vary, depending on the selection you made in the first dropdown.

- Equals: Enter the search criterion (e.g., the full description or folder name) in the field to the right, or select the correct date from the dropdown calendar (if applicable). Click Find.

- Within Range: Search between two calendar dates. Click the down arrow to the right of each field to choose dates from the dropdown calendars. Click Find.

To see the filter that is currently applied to the list, hover over the Search where text.

You can apply multiple filters if necessary.

- To apply multiple filters to the list, do one of the following:

- Click the Edit

Filter button

.

. - Press [Ctrl] + E.

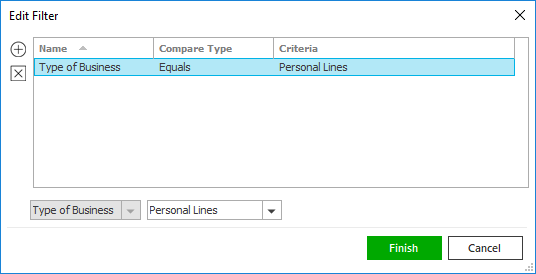

- The Edit

Filter pop-up window displays.

Note: You can also use the Edit Filter button, rather than the search bar, to apply a single filter to the list if you prefer.

- Select and/or enter your desired search criteria using the dropdown menus and fields, and then click the Add button. The Name, Compare Type, and Criteria for your filter display in the list. Click one of these column headings to sort the list by that column. To reverse the sort order, click the column heading again.

- To apply additional filters, enter additional search criteria and continue clicking Add. To remove a filter from the list, select it and click the Delete button.

- Click Finish

when you have applied all of your desired filters.

To exit the dialog without applying any filters, click Cancel.

- You can change

the columns that display in the list if necessary.

- Click the Select Columns link label on the right side of the header.

The Select Columns window displays.

- Select the checkbox next to each column that should be included in the list.

Deselect the checkbox next to each column that should be removed from the list.

- Columns will display in the order in which they are listed.

In the example above, Refer

# would be the first column and Amount

would be the last. To move a column up or down in the list,

click on the column

and then click the up

arrow

or

down

arrow

or

down

arrow  to

change its position.

to

change its position. - Click OK or press [Enter] to save your changes.

Click Cancel to close the window without saving your changes.

. Prior versions cannot be modified;

their detail displays as read-only.

. Prior versions cannot be modified;

their detail displays as read-only.