Access the Reconciliations area.

- To access the General Ledger from the Home screen, do one of the following:

- Click General Ledger on the navigation panel.

- Click Areas > General Ledger on the menubar.

- Click the down arrow next to Home on the options bar and select General Ledger.

To access the General Ledger from another area of the program, do one of the following:

- Click Home > General Ledger on the menubar.

- Click the down arrow next to Home on the options bar and select General Ledger.

- Click Reconciliations on the navigation panel or Areas > Reconciliations on the menubar.

Click Government Payable under Reconciliations on the navigation panel.

- The Government Payable Reconciliations

screen displays. Enter

your desired search criteria to populate the list.

Click here for an explanation of reconciliation statuses.

Click here for information regarding Master Statement Numbers.If you are reconciling multiple agencies using the same criteria, a single suspended reconciliation statement is created for which a master statement number is generated. When the statement is finalized, a separate statement is created for each agency. These statements have unique statement numbers but share the same master statement number. This enables you to work on items for different agencies together while the statement is suspended, but to pay the agency statements separately once it is finalized, meaning the correct General Ledger payable accounts per agency are affected.

When you reopen a finalized direct bill commission statement, all other statements associated to the same master statement number are automatically reopened as well.

- Processing/Suspended/Finalized/Approved

- Processing: Flagging all items submits the job to the central server. Once all items have been flagged, the statement’s status is updated to Suspended.

- Suspended: Work in progress.

- Finalized: The statement is complete.

- Approved: The statement has been approved for payment. The statement's status is updated to Approved via the Approve for Payment action.

- Paid/Unpaid/Closed

- Paid: Paid via the General Ledger.

- Unpaid: Not yet paid via the General Ledger.

- Closed: This status removes the selected reconciliation from the Unpaid reconciliation statement list. The Close Without Paying action allows you to close a statement that will not be paid. The Close Without Paying action should be used only if the organization is cleaning up old payables or if the statement’s amount is 0.00. Using this action on a basic statement might result in an out-of-balance situation.

Re-Opened: When a statement has been re-opened, this indicator is always set. This is because once a statement is re-opened, it cannot be deleted. The Delete Statement option is allowed only for suspended statements that have not been re-opened.

To locate reconciliations that match specific criteria, use the search bar. Make a selection in each dropdown menu to locate the desired reconciliation. The fields vary, depending on the menu options you choose.

These are the choices in the first dropdown menu:

- Agency

- Date Entered

- Due Date

- Entered By

- Government Entity Code

- Government Entity Name

- Master Statement #

- Paid Status

- Payment Address

- Payment Contact

- Recreated

- Refer #

- Reopened

- Reversed

- Rework

- State/Province Code

- State/Province Name

- Statement #

- Statement Status

The choices available in the second dropdown menu vary, depending on the selection you made in the first dropdown.

- Equals: Enter the search criterion (e.g., the exact government entity code or user ID) in the field to the right, or select the correct date from the dropdown calendar (if applicable). Click Find.

- Contains: Enter at least one character of the criterion.

- Within Range: Search between two different calendar dates of your choice. Click the down arrow to the right of each field to choose dates from the dropdown calendars. Click Find.

Notes:

- If you selected Paid Status, select Paid, Receipts, Disbursements, Vouchers, or Unpaid from the second dropdown. Click Find.

- If you selected Recreated, Reopened, or Reversed, select Include or Exclude from the second dropdown. Click Find.

- If you selected Rework, select Exclude, Include, or Only from the second dropdown. Click Find.

- If you selected Refer #, select Disbursement, Journal Entry, Receipt, or Voucher from the third dropdown. Click Find.

- If you selected Statement Status, select Approved, Finalized, or Suspended from the second dropdown. Click Find.

To see the filter that is currently applied to the list, hover over the Search where text.

Reconciliations matching the criteria selected in the filter display in the list. To sort by a different column, click the column heading by which you wish to sort. Click one more time to change the sort order (from ascending to descending, or vice versa).

Click the Select Columns link label to change the columns that display in the list or the order in which they display.

Detail for the highlighted reconciliation displays below the list.

You can apply multiple filters if necessary.

- To apply multiple filters to the list, do one of the following:

- Click the Edit

Filter button

.

. - Press Ctrl + E

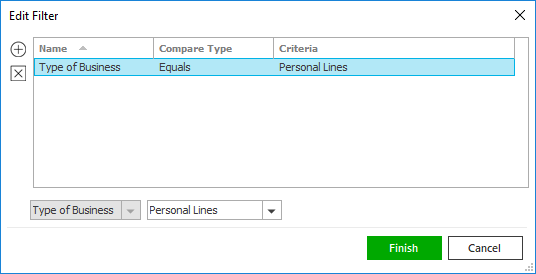

- The Edit

Filter pop-up window displays.

Note: You can also use the Edit Filter button, rather than the search bar, to apply a single filter to the list if you prefer.

- Select and/or enter your desired search criteria using the dropdown menus and fields, and then click the Add button. The Name, Compare Type, and Criteria for your filter display in the list. Click one of these column headings to sort the list by that column. To reverse the sort order, click the column heading again.

- To apply additional filters, enter additional search criteria and continue clicking Add. To remove a filter from the list, select it and click the Delete button.

- Click Finish

when you have applied all of your desired filters.

To exit the dialog without applying any filters, click Cancel.